Keep getting this error when you push orders over to QuickBooks Online using MyWorks Sync?

Cause

Either a tax code or tax rate is not set for one of the line items in your order.

Resolution

There are three tax-related areas in our integration to ensure they are correctly set:

- MyWorks Sync > Settings > Taxes. Ensure you have a valid 0% Tax rate set here. This is usually or Out of Scope or No VAT - but can vary based on your QuickBooks company. If this is set to Exempt, try changing to a different 0% rate.

- MyWorks Sync > Map > Taxes. Ensure that all of your tax rates in use in WooCommerce are mapped to a valid/appropriate tax rate in QuickBooks Online.

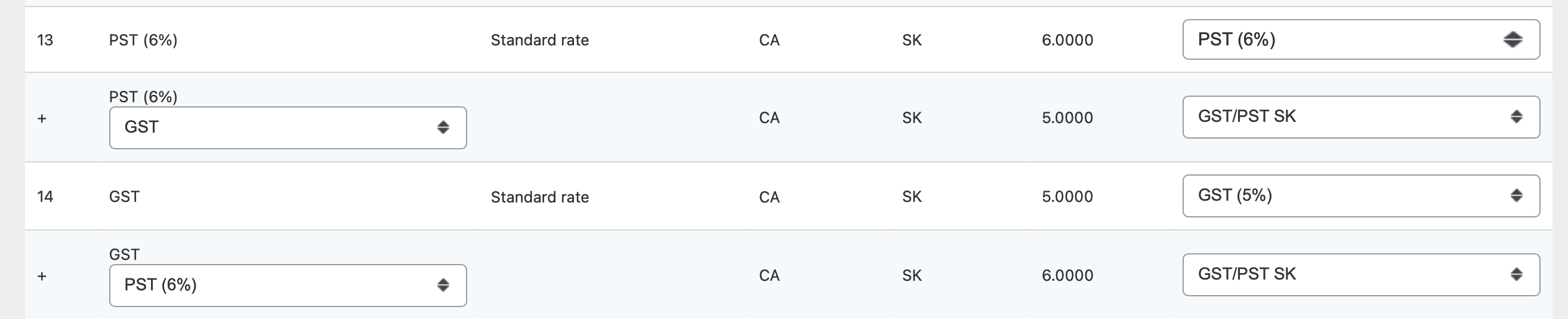

- Check if the WooCommerce order uses more than one tax rate (typical in Canada). QuickBooks Online only supports one tax rate for each line item, so if there are two tax rates in your WooCommerce order, these need to be compound-mapped to the single combined rate in QuickBooks at MyWorks Sync > Map > Taxes.

Example:

You can find more details on compound mapping your taxes in our Best practices on mapping taxes article.