MyWorks makes it as easy as possible to handle accounting for the sales tax collected in Shopify orders from Canada. We'll automatically sync the tax charged on the order into QuickBooks Online as we sync the order: all that's needed is mapping your Canada tax rates in Shopify to their corresponding tax rates in your QuickBooks.

Setting up sales tax for Canada

If your QuickBooks Online company locale is in Canada, you'd manage your Canada QuickBooks tax rates manually in your QuickBooks Tax > Sales Tax tab.

MyWorks allows you to easily map your Shopify sales tax rates to the sales tax rates present in your QuickBooks company. There are two areas in MyWorks to manage this.

Settings > Tax

In MyWorks Sync > Settings > Tax, you can set your QuickBooks tax rate that should be applied to items that are not taxed in your Shopify orders. This is normally a tax rate named “Out of Scope”, or “Exempt”.

Map > Tax Rates

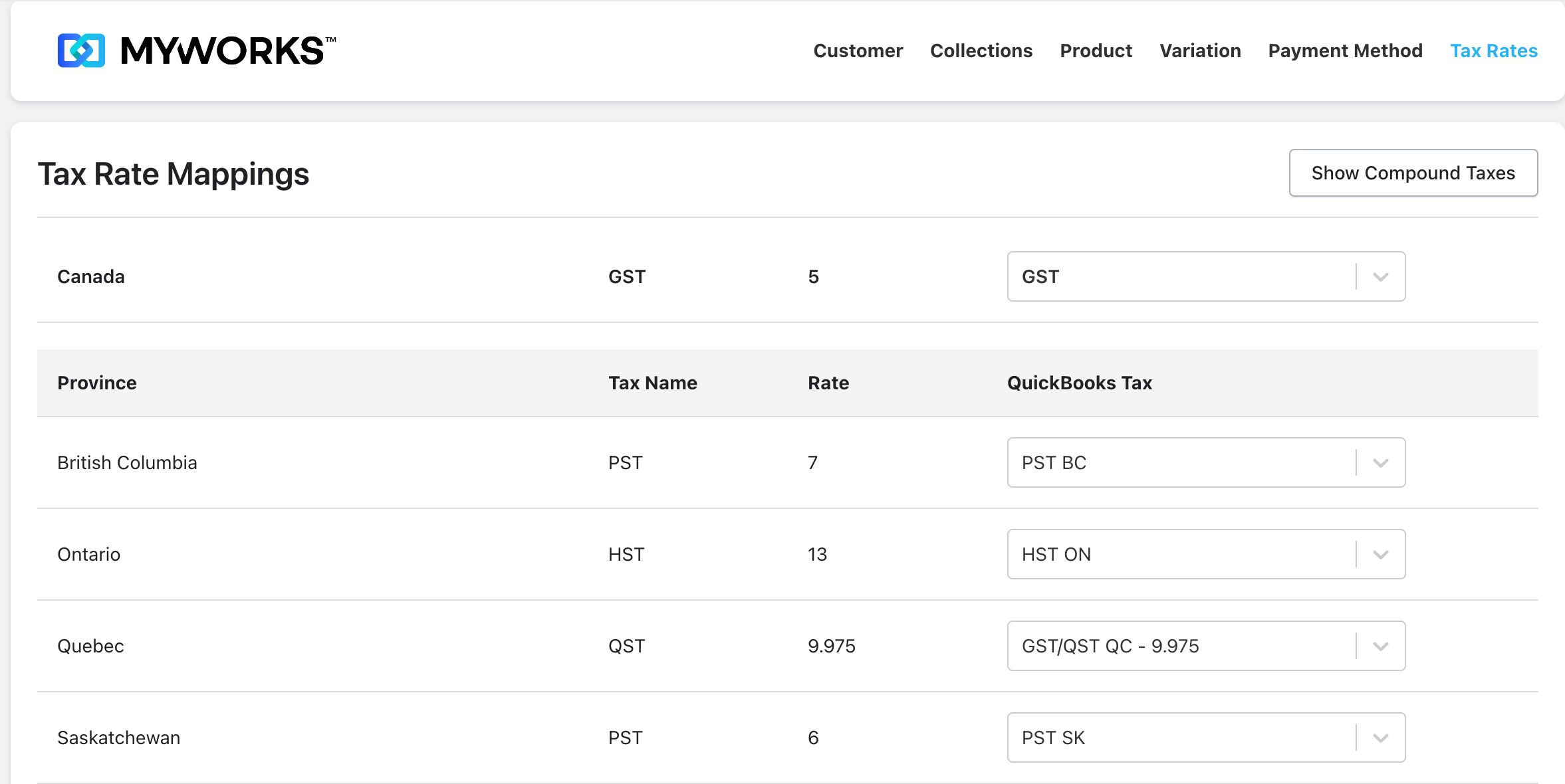

In MyWorks Sync > Map > Tax Rates, you can view your Shopify tax rates and select the matching QuickBooks tax rate for each.

- The Canada GST rate would be shown first - and should be mapped to your 5% GST rate, as shown below.

- Any province you're charging sales tax for in Shopify can then be mapped to its corresponding QuickBooks tax rate, like in the below example.

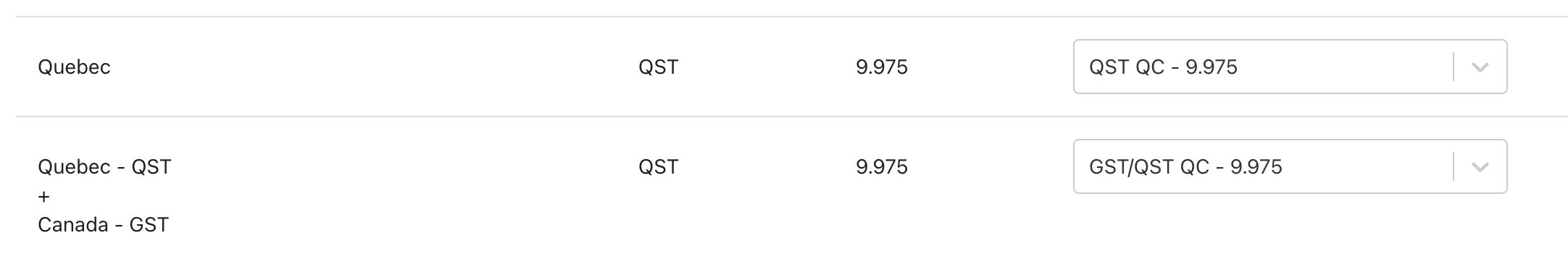

MyWorks also supports compound mapping, like in the below example where GST + QST for Quebec would be charged in the same order - to map these rates in Shopify to the correct combined rate in QuickBooks.

Syncing tax as a line item

Alternatively, if you do not wish to use the QuickBooks Online Automated Sales Tax feature, and/or have sales tax turned off in QuickBooks, you can sync tax as a line item in the QuickBooks order instead.

You can enable the setting to sync sales tax as a line item in MyWorks Sync > Settings > Tax, and the line item used in QuickBooks can be controlled in several different ways:

- You can select a single QuickBooks product to be used for the sales tax line in QuickBooks. This is the item that will be used by default, unless a QuickBooks product is selected for the country/region in the section below.

- In the section below, you can select a specific/different QuickBooks item to use for the sales tax based on the country or region of the order. This can be helpful to track sales tax collected in separate accounts in QuickBooks based on the country, US state, or Canadian Province that the sales tax was collected for.

If a country or province is not assigned to a QuickBooks item in the below section, MyWorks will follow its tax rate mapping instead, in MyWorks Sync > Map > Tax Rates.

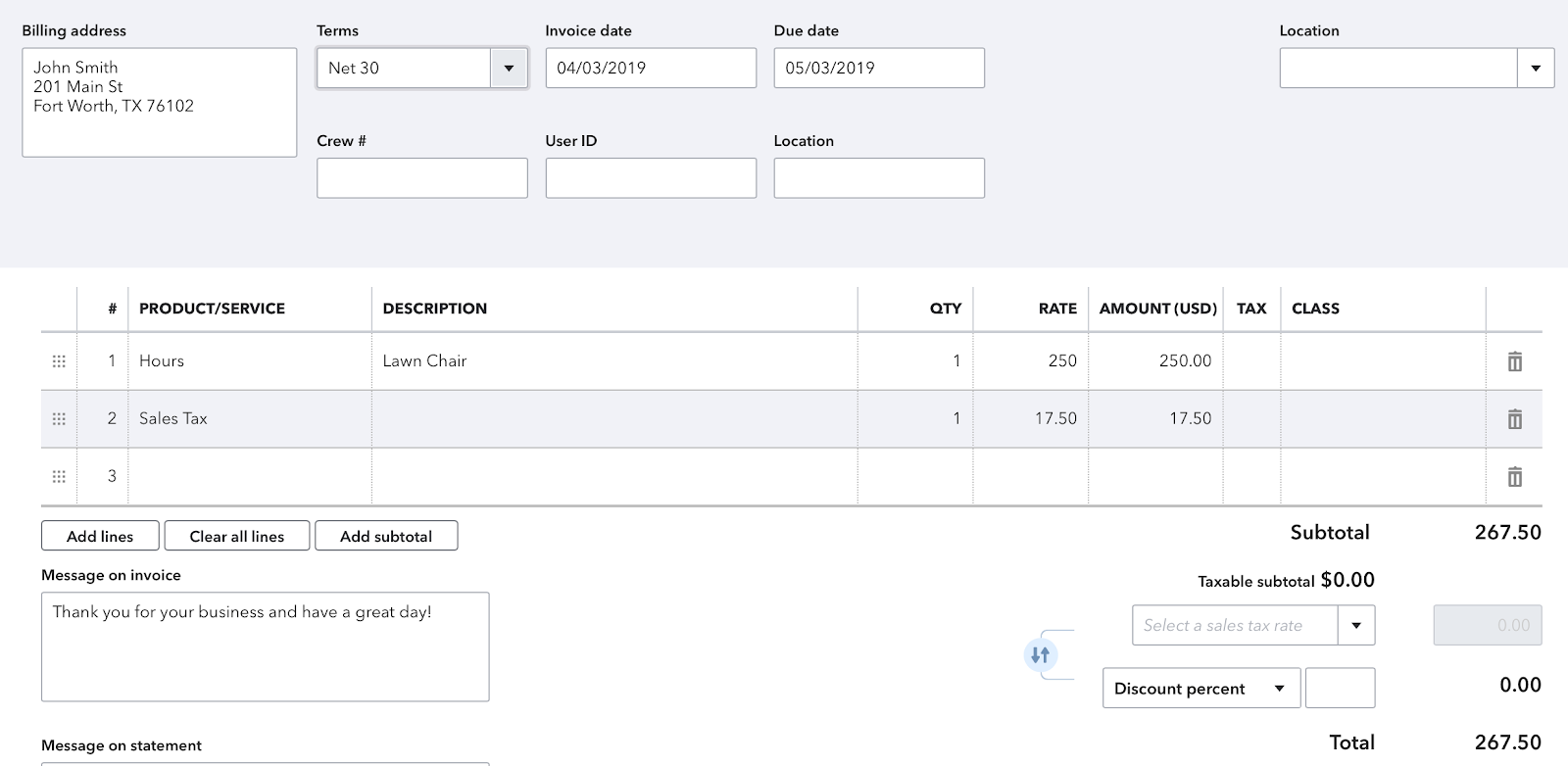

Once enabled, the Sales Tax collected in the Shopify order will be synced as a line item in the order in QuickBooks Online, as shown in the below example: