MyWorks makes it as easy as possible to handle accounting for the sales tax collected for Shopify orders in any country where you charge sales tax in Shopify. We'll automatically sync the tax charged on the Shopify order into QuickBooks Desktop as we sync the order!

MyWorks is compatible with global tax rates configured in Shopify for any country - allowing you to map your Canadian tax rates from Shopify to the corresponding sales tax rates you've set up in QuickBooks.

Located in the United States or Canada? Check out our docs that specifically cover these regions.

Tax Settings

In MyWorks Sync > Settings > Tax; the options can be configured like the below screenshot - setting a taxable and nontaxable code in QuickBooks, and ensuring the Sales Tax Mapping Format is set to (Outside of the United States) - if your QuickBooks Desktop locale is not in the US.

%20%C2%B7%20Shopify%202025-09-16%20at%204.18.12%20PM.png)

Mapping tax rates

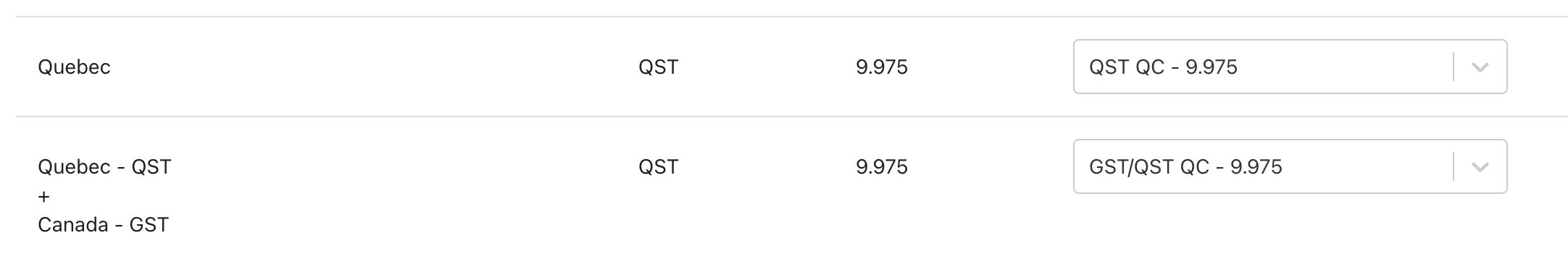

Then, you can visit MyWorks Sync > Map > Tax Rates, where you can easily map your Shopify Sales Tax rates to the corresponding rates you've created in your QuickBooks Item List.

Once set, MyWorks will follow this tax rate mapping as orders are synced to QuickBooks - populating the correct tax rate in the Sales Tax dropdown at the bottom of a QuickBooks order.

MyWorks does support multiple tax rates in a Shopify order - for example GST + QST in Canada. Use the Compound Tax Mapping option in MyWorks, which allows you to map two Shopify tax rates to a single combined (Group) tax rate in QuickBooks, since QuickBooks allows only one sales tax item per line.