As sales tax management and nexus become more and more complex, our MyWorks Sync users continue to turn to popular sales tax automation platforms - which help reduce the time/effort spent manually managing sales tax rates in WooCommerce by automatically calculating the exact sales tax value for each order as it's placed - based on the user's shipping address.

These sales tax automation platforms include WooCommerce Automated Sales Tax, Avalara Avatax, TaxJar, and Taxify.

MyWorks Sync for QuickBooks Online is compatible with these automated tax calculation systems. We'll automatically sync the tax charged on the order into QuickBooks Online as we sync the order. How we handle the order depends on whether you have Automated Sales Tax enabled in QuickBooks Online.

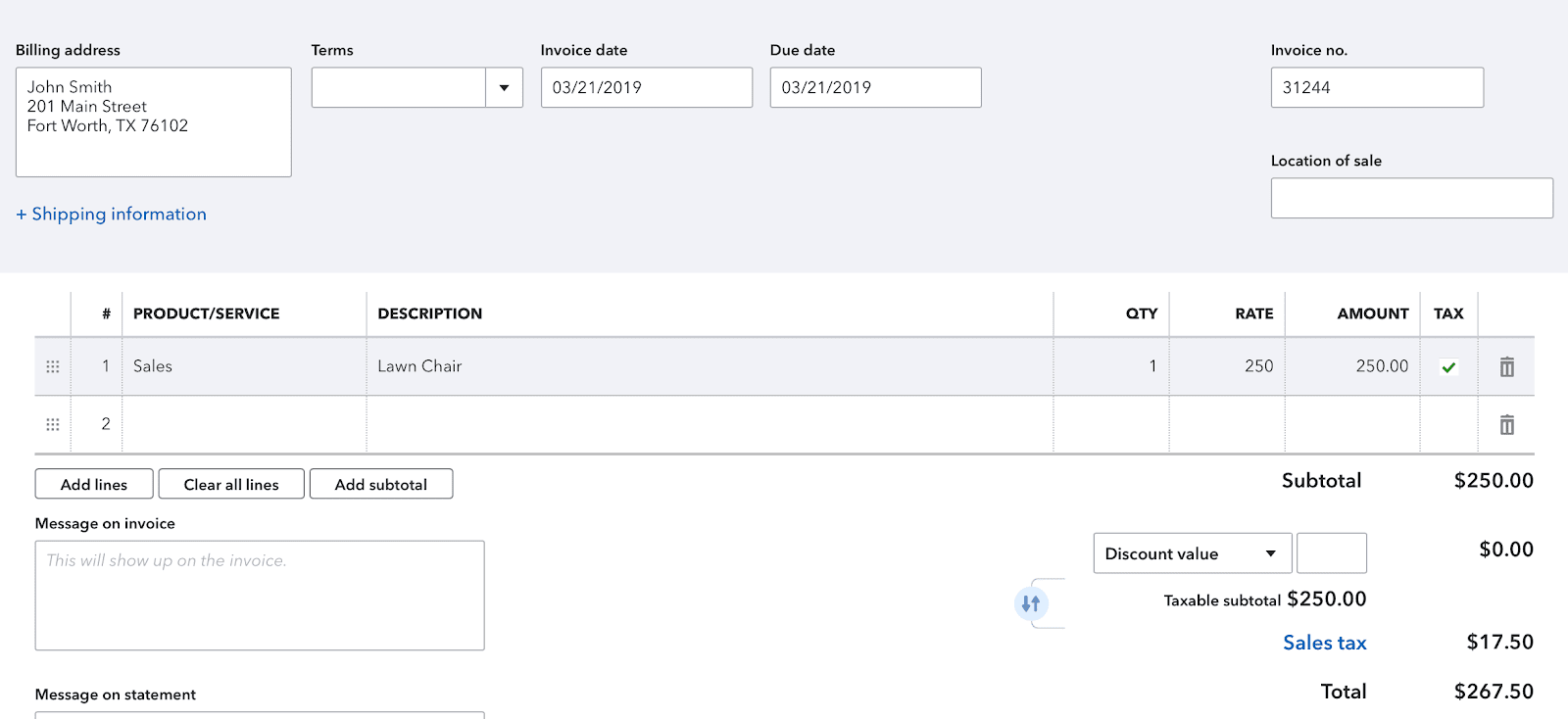

With Automated Sales Tax Enabled

The Sales Tax collected in the WooCommerce order will be passed into the "Sales Tax" line item in QuickBooks Online. This will always match what's collected in WooCommerce.

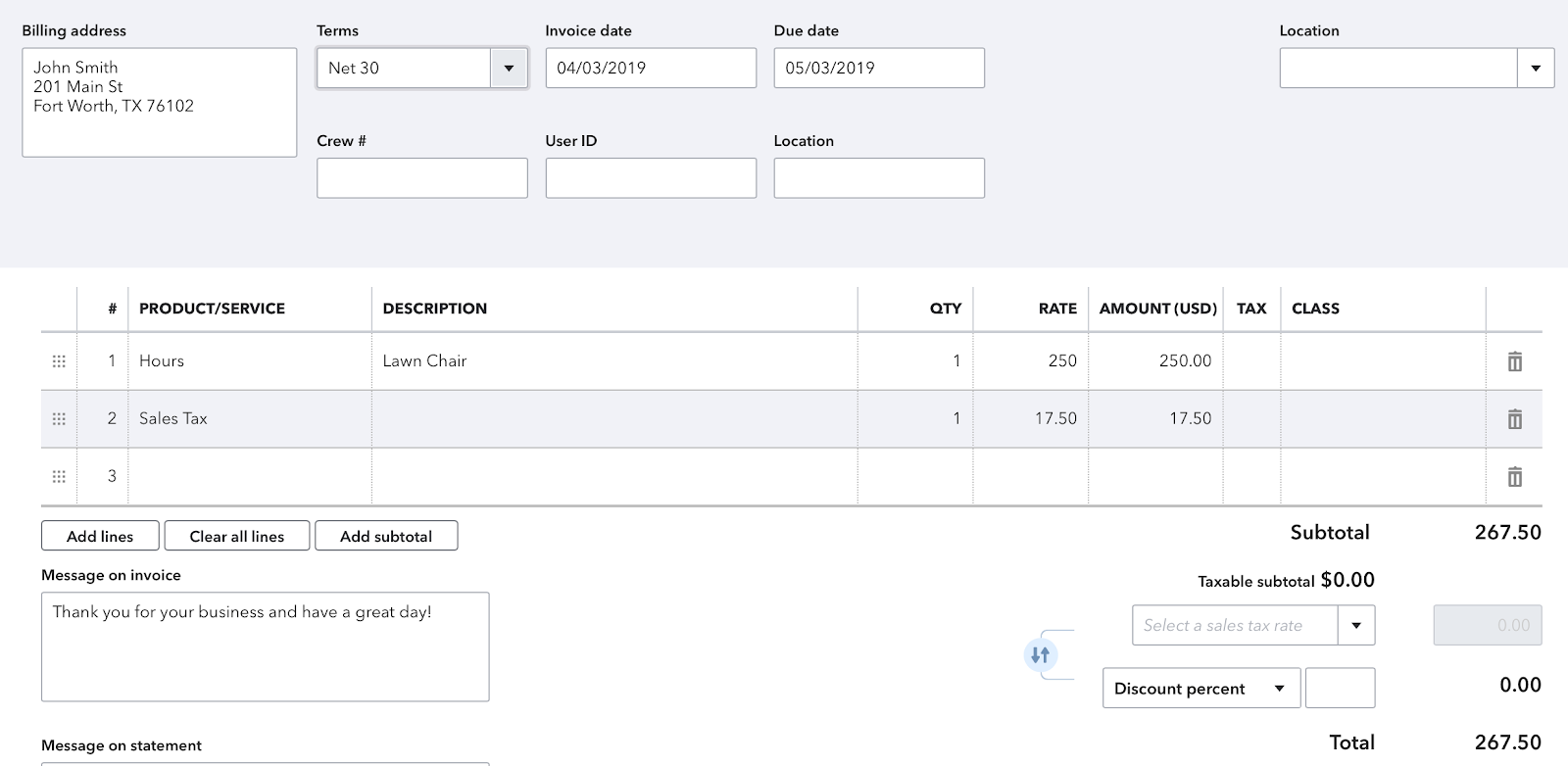

Without Automated Sales Tax Enabled

The Sales Tax collected in the WooCommerce order will be passed into a line item in QuickBooks Online called Sales Tax. This "Sales Tax" item is set in MyWorks Sync > Settings > Sales Tax - and can be created in QuickBooks and assigned to your "Sales Tax Payable" account.

Without Automated Sales Tax enabled in QuickBooks, the calculated sales tax in WooCommerce must be passed into a QuickBooks line item, as it's not possible to match it to a set rate in QuickBooks.