Typically, when dealing with credit card batch deposits in Xero, it's common to use a separate Xero account like Undeposited Funds or a holding/clearing bank account to "hold" payments as they're in-transit to your bank account.

Using a holding account in Xero for credit card sales

This method involves creating a separate Bank Account in Xero to act as a holding account for funds until they're deposited into your physical bank account by your card processor. This can be called "Credit Card Holding Account", for example.

Then, in MyWorks Sync > Map > Payment Methods, MyWorks Sync can be set to sync payments into this holding account.

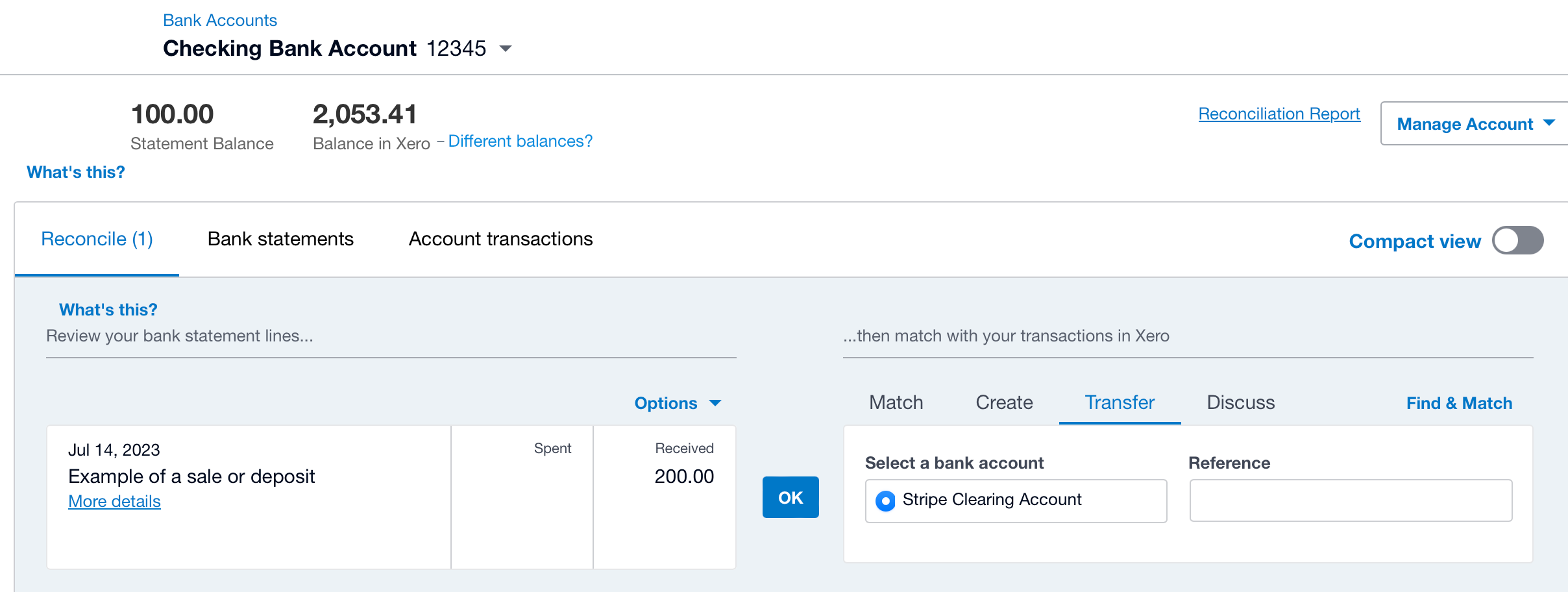

Orders will then be synced into this account in Xero, and instead of "Matching" transactions in the Banking feed in Xero, they can be "Transferred" from this holding account.

This results in your "holding" account containing a remaining balance of the difference between your gross sales for the day and the net sales sent to your bank account - which would represent the transaction fees for these sales. Or, transaction fees can be included in each order as a negative line item, so there's no different left in this account.

Transaction Fee Handling

With this method, transaction fees can be accounted for by MyWorks as well.

Transaction fee syncing can be enabled in MyWorks Sync, which will sync transaction fees into Xero in each order as a negative line item. This would result in the order in Xero having a total of the “net” amount you receive, and be able to correctly reconcile with the deposit sent to your bank account from your processor.

Example

For example, if you had $550 of orders on Monday, these would be synced into Xero automatically by MyWorks Sync - and if transaction fee syncing is enabled in MyWorks, would result in this holding account having a balance of $507.97, for example: the net amount (gross sales minus transaction fees).

Then, on Wednesday, your credit card processor deposits the net amount (gross sales minus transaction fees) for Monday's sales into your bank account - which is $507.97, for example.

This amount can then be "transferred" from your holding account in Xero in your Banking feed. This then leaves your holding account with a balance of $0.