Typically, when dealing with credit card deposits/batches in QuickBooks, it's common to use a separate QuickBooks account (like Undeposited Funds) to "hold" payments, and then "group" them in a Bank Deposit to move then into a QuickBooks checking account. MyWorks Sync can automatically handle this - and include transaction fees - with our Batch Support feature.

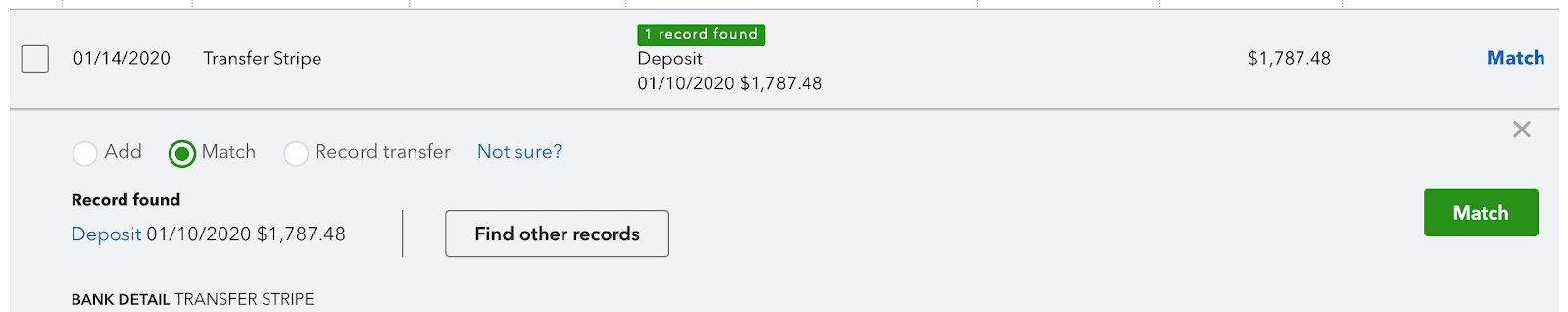

This method is helpful in ensuring that sales are accurately recorded in QuickBooks Online and that individual sales receipts or payments are "matched" to a specific banking transaction through the Bank Deposit that's created to group these sales together and match to a specific bank transaction in your QuickBooks banking feed.

Downside of the Batch Support / Bank Deposit method

However, the one downside of this method is that for this Bank Deposit to show as a "match" to a transaction in your QuickBooks bank account, the totals of these two transactions must match exactly. If the QuickBooks bank deposit is off by even $.01, due to refunds, different transaction fees, or another reason - a match will not show as available, and manually effort would be required to find and adjust the related bank deposit to match the totals.

Because of this downside, which can be especially magnified when dealing with transactions at scale - (e.g. 100+ orders/day) - this can result in significant manual effort in matching these deposits if the totals aren't exact.

Using a holding account in QuickBooks for credit card sales

Thus, there is an alternative method available to still ensure sales are correctly synced to QuickBooks, the transaction fees recorded, and the credit card deposits properly accounted for in QuickBooks - but without the manual effort of ensuring matching bank deposits.

This method involves creating a separate Bank Account in QuickBooks to act as a holding account for funds until they're deposited into your physical bank account by your card processor. This can be called "Credit Card Holding Account", for example.

Then, in MyWorks Sync > Map > Payment Methods, MyWorks Sync should be set to sync payments into this holding account - and batch support should be turned off.

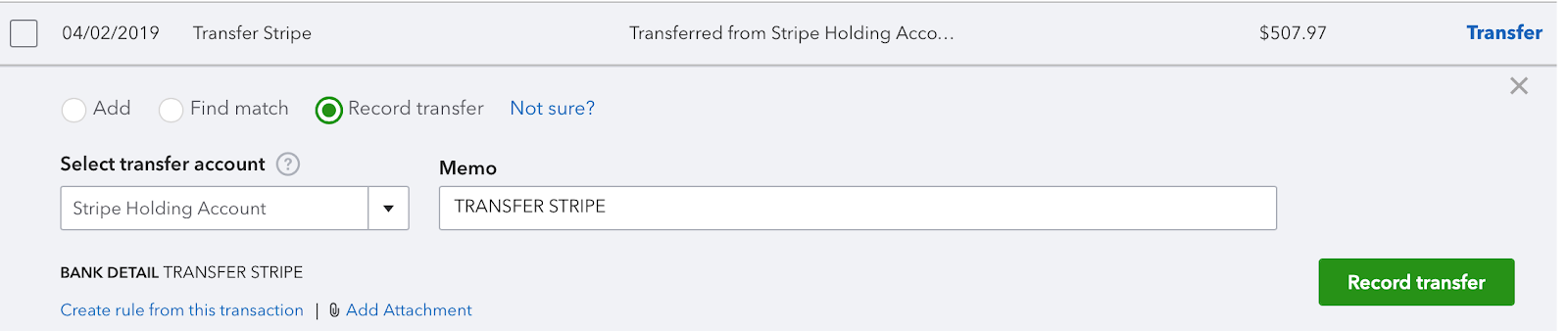

Orders will then be synced into this bank account in QuickBooks, and instead of "Matching" transactions in the Banking feed in QuickBooks, they should be "Transferred" from this holding account.

This results in your "holding" account containing a remaining balance of the difference between your gross sales for the day and the net sales sent to your bank account - which would represent the transaction fees for these sales.

Example

For example, if you had $550 of orders on Monday, these would be synced into QuickBooks automatically by MyWorks Sync - resulting this holding account having a balance of $550.

Then, on Wednesday, your credit card processor deposits the net amount (gross sales minus transaction fees) for Monday's sales into your bank account - which is $507.97, for example.

Like the screenshot above, this amount should be "transferred" from your holding account in QuickBooks in your Banking feed. This then leaves your holding account with a balance of the difference: $42.03. This represents the transaction fees from this deposit, and can then be transferred to your transaction fees expense account on a daily, weekly, or monthly basis, for example.

Transaction Fee Handling

With this method, transaction fees can be accounted for and kept accurate in two different ways:

- A transaction fee report can be pulled from your card processor to compare the transaction fees recorded monthly or weekly. This would help ensure that the remaining balance in this account does match the actual transaction fees assessed during this period.

- Transaction fee syncing can be enabled in MyWorks Sync, which will sync transaction fees into QuickBooks for each order - coming out of your holding account and into your transaction fees expense account. This would then result in an ongoing balance of $0 in the holding account - which would help identify any issues if this balance is not $0.

- Not Seeing your Transaction Fees or Transaction ID record on a WooCommerce Order? Read This