Although our Batch Deposit support functionality for MyWorks Sync works with any payment processor that batches your daily sales into one deposit and sends those in one deposit to your bank account a few days later, the most popular payment processor with our users is Stripe - so we have additional integration with Stripe to ensure that batch deposits are as simple as possible.

You can read how to set up Batch Support here. This takes care of the initial setup.

Stripe-related Settings

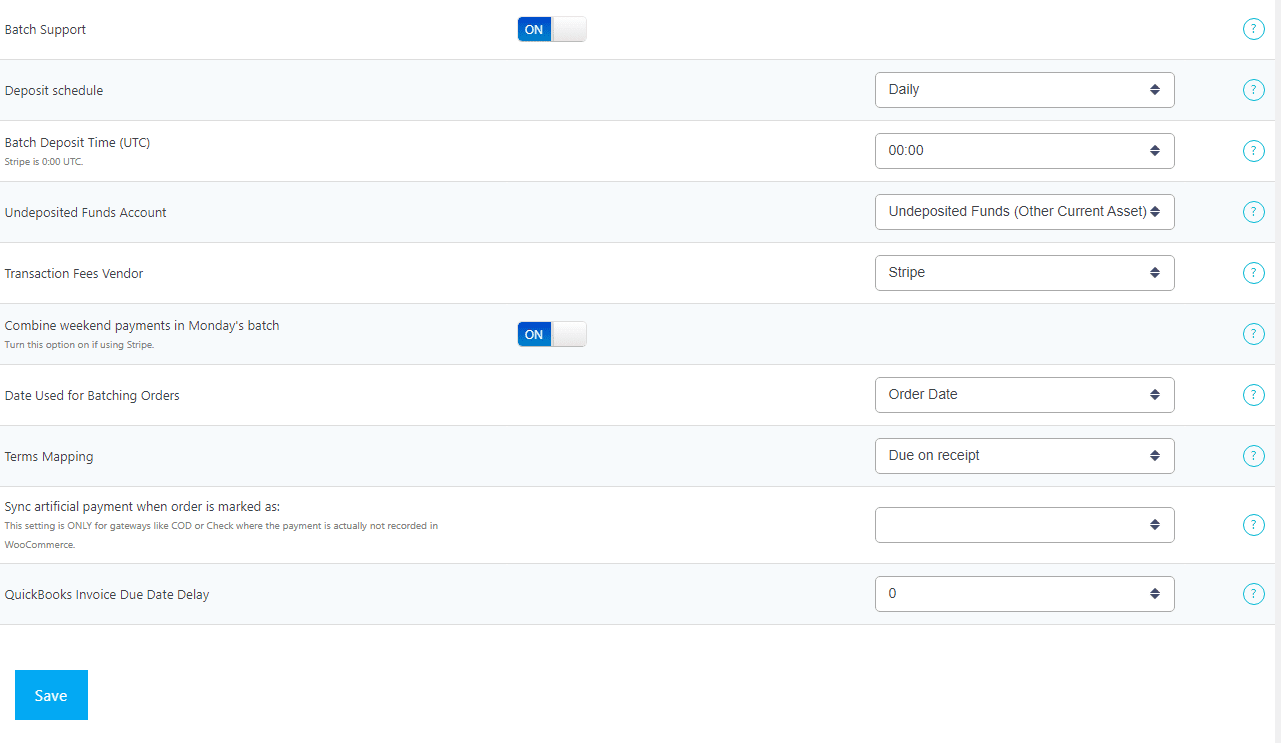

There are a few additional settings/ helpful features to enable in our sync when using Stripe as a gateway, if you're using our batch support with it.

1. Deposit Time (UTC)

Stripe's Deposit Schedule is usually "Daily", unless set otherwise in your Stripe settings.

Stripe's batch cutoff time is at 11:59pm UTC. This means that you need to set the "Deposit Cron Time" value in Map > Payment Methods to 0:00 UTC to ensure the cutoff time is correct when our sync makes the bank deposit in QuickBooks.

2. Weekend Batches

Although Stripe cuts off batches at the 11:59pm UTC for every business day, they do not batch payments made during the weekend. This means that Stripe's batch schedule is as follows:

Tuesday: Normal batch (12am UTC - 11:50pm UTC)

Wednesday: Normal batch (12am UTC - 11:50pm UTC)

Thursday: Normal batch (12am UTC - 11:50pm UTC)

Friday: Normal batch (12am UTC - 11:50pm UTC)

Saturday: No Batch

Sunday No Batch

Monday: Extended Batch for all payments made from after Friday's batch to 11:59pm UTC on Monday.

If we synced deposits over separately for Saturday, Sunday and Monday; this would result in a mess of deposits to try and match to a single bank deposit in your banking feed later in the week.

So, you need to enable the switch to "Lump Weekend Deposits" in your Map > Payment Method Mappings section for Stripe. See below for a screenshot.

Keep in mind that Stripe does alter their Payout schedule around certain US holidays, so there will be a few times over the course of the year that the bank deposits we create in QuickBooks won't exactly match the deposit in your Banking feed - and you'll need to manually edit the bank deposit to adjust in QuickBooks.

Refund Handling

The way Stripe handles refunds when processing daily payouts is a bit abnormal, and can throw a small bump into perfectly matching up deposits in QuickBooks.

When a payment is processed in your Stripe account, it will be included in a batch (payout) for that day to be sent to your bank 2-3 days later. However, when a refund is processed in your Stripe account, Stripe retroactively includes it in the payout that was already recorded 2-3 previously. This is to ensure that Stripe can pull that refund out of your bank account today, instead of having it hit 2-3 days from now, like a normal payment.

Because of this, it makes it very difficult for MyWorks Sync to also retroactively include this refund inside of a deposit we already created in QuickBooks 2-3 days ago, when we sync the refund into QuickBooks. Thus, we currently only will sync the refund into QuickBooks - and it will need to be manually added to the correct deposit in QuickBooks in order to ensure the deposit matches the funds received in your QuickBooks bank accounts.

This can be easily done by searching QuickBooks for the deposit for that day, editing the deposit that we synced over, and checking the box next to the refund we synced over to include that refund in the deposit.

We do have plans for a cleaner sync here, and the ability for MyWorks Sync to automatically re-include the refund in a previous deposit is in our product roadmap.